|

Understanding Options - What Are Calls and Puts?

All options are basically contracts on some underlying trading instrument - shares of a stock or share, over a bond contract, maybe over one of the many commodities traded, a mortgage or loan of some sort, etc. (The list is long and covers many different forms of financial instruments.) But regardless of what the basis for the option contract is, there are common features that all options poses. One of the most basic is the contract feature specifying the rights and obligations that the option buyer or seller has actually contracted for. What Are Call Options?A 'call' option confers on the (option) contract holder the right (but not

the obligation) to buy an asset at a fixed price on or before a specified expiration date.

The owner of a call option always has the choice on whether to exercise his

option or let his it expire. (Of course, if he let's it expire worthless, he

will lose the initial money he invested in buying the contract.) How much of a price rise in the underlying security is enough? The price of the underlying security needs to rise enough to cover the difference between the market price and the strike price (the

strike price is the price which the stock, say, can be purchased). And since the option itself has a

cost (called the option premium), the price has to rise enough to cover the additional

amount of premium paid. With less time remaining until expiry, the odds are lower and therefore the

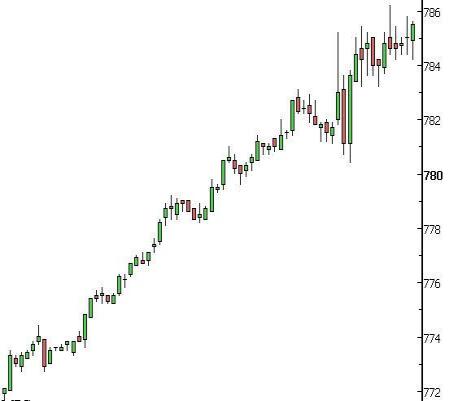

risk to the option holder is much higher. Here's a chart of a strongly rising market where holding call options would be very profitable. Buying additional call option contracts at each higher swing low and compounding your position would have been a very profitable trade... What Are Put Options? A 'put' option, on the other hand, gives the option buyer the right (but

again, not the obligation) to sell an asset at a certain price by a certain date

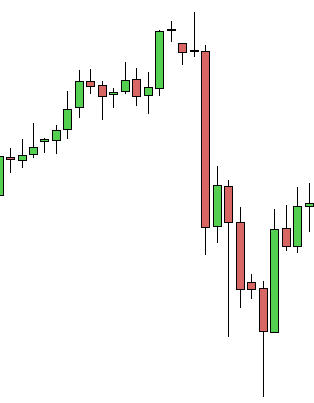

in the future. In this case the market price must fall below the strike price in order to profit from exercising the option. (Ignoring the cost of the put, for simplicity.) Under those circumstances, the option holder is 'in the money'. Here's a chart of a quickly falling market - the setup here would be to buy put options either once the small swing low before the second doji was taken out, or below the prior swing low. These short quick trades can make holding put options very profitable -

Whether investing in calls or puts, wise investors do the needed homework. Options trading is risky and somewhat more complicated than simple stock trading. (Which is already complicated and risky enough.) A well thought out trading plan along with an understanding of how options work can help you to become a profitable options trader. Having said that, the vast majority of options expire worthless, so it pays to have a good grasp of trading trends and an understanding of technical analysis before you enter the options market. And if you'd like to cut out all the hype and B.S. about learning to trade options and learn EXACTLY how to do it right from an expert, check out The Options University. Your membership includes everything you need to start trading options profitably TODAY! Visit The Options University today... Visit Our Premium Partner

Click

Here To Return To The Options Information Home Page

|